Consultation of Customs accounting and management

Consultation for Customs policies

Accounting of Customs business

Control of Customs business cost

Reforging of Customs business workflow

Management of Customs business information

Supervision of the networks for Customs business

Promotion of Customs credit

Transform of Three types processing plus compensation trades

Evaluation of the risk for Customs business

Disposition of the crisis issues in Customs business

Training of the professionals for Customs business

Compiling of Customs transaction report

Consultation of Finance, Taxation, Foreign Exchange

Consultation for investment policies

Tutoring of the accounting system construction

Tutoring of the financial management system construction

Management of budget compiling

Management of performance assessing

Management of tax revenue collocation

Management of cancelling after verification for foreign exchange

Management of cash flow

Management of interior risk

Management of cost and expenditure

Accounting of transaction sales in domestic market

Management of Customs drawback

1. CounselingCustoms Affairs Management

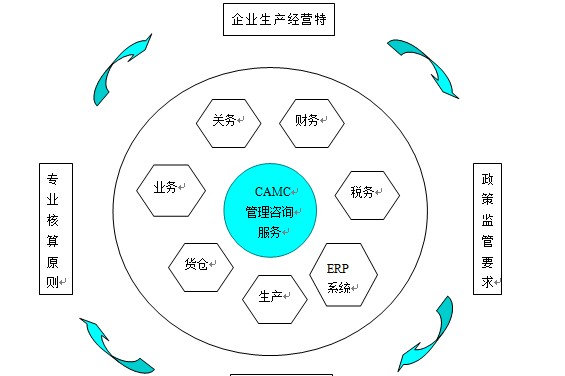

Customs policies and regulations, Customs administrative mode, Customs organized system, Customs operating standards, Customs accounting methods, Customs trusting grade, Customs critical incidents, Customs operating group, ways of processing trade, etc. deal with the enterprises’ operation cost, operation efficiency, operation quality and operation risks. Taking the “Customs affairs management” as the core, CAMC well targetedly provides the following onsultancies and services: Customs affairs organization design, Customs affairs procedure remaking, Customs affairs professional accounting, bonded logistics supervision, three accounts balance, Customs credit upgrading, Customs risk evaluation, Customs afairs training, “processing and compensation” transferance, critical incidents disposition in order to strengthen the enterprises’ Customs affairs management, lower the operation cost and raise Market Competitiveness.

2. Counseling Fiscal and Tax Coordination

The materials import prices, the final products’ exporting prices, the processing charges, the choice of purchasing channels, the selling decisions directly related to the enterprises’ important financial and tax matters of Customs duties, value added tax, incomes tax, export tax rebate, foreign exchange verification, and cash flow. Taking “financial affairs and taxation affairs” as the core, CAMC targetedly provides the following consultancies and services: financial image planning, tax coordination, verification of foreign exchange balance, cash flow control, special management of tax rebate, tax risk management, cost management, relevant financial accounting, interconnection of Customs affairs, financial affairs and taxation, in order to accommodate with the combination of professional verification principles and the enterprise’s producing and operating characteristics, thus making the needs of the supervision of Customs, taxation and foreign administation policies to build the enterprise’s good public image.

3. CounselingCustoms Affairs Informationization

The collection, processing, circulation, share and operation of Customs information bringing into MIS (ERP) system is the key for enterprises’ informationization of Customs affairs, and the groundwork for enterprises to achieve the supervision of electronic communication networksas well. Taking the “Customs affairs informationization” as the core, CAMC targetedly provides the following consultancies and services: Customs accounting criterion, Customs computation standards, document planning, mergering and splitting of classification, interconnecting information of Customs and enterprises, disposition of information feedback, supervision of electronic communication networks, in order to achieve the accuracy, promptness, integrity, clarity, interlinkage and sharing, thus tamping the foundation of Customs supervision of communication networks to upgrade the efficiancy and quality of Customs affairs management and keep away the risks of Customs affairs operation.

4. Customs Affairs Consultation of Supply Chain

Suppliers, clients, bonded warehouses, Customs brokers, transportation companies, and even the intercompany sections of purchase, Customs affairs, warehouses, production, and distribution, e.g. the whole supply chain system, involve the complicated Customs affairs of Commodities’ HS codes, commodity names, units of measurement, Customs declaration and clearance, carry-over applications, goods transferance, carry-over declarations. Taking the “supply chain” as the core, CAMC targetedly provides the following consultation and services: evaluation of suppliers’ customs risks, risk management of clients’ customs affairs, customs cost control of the third party logistics, customs risk management of deep processing carry-over, customs special audit of JIT trading, inner information sharing of bonded business, in order to guarantee the import and export goods, bonded goods to be cleared by the Customs, unhinderedly carried over, thus insuring the supply chain’s customs risks orderly and effectively controlled.